ny paid family leave tax code

New York State Paid Family Leave. The original Turbo Tax answer about a year ago to this question was incorrect which is why I responded as I did with the correct info and the NYS link stating that NYPFL is a state disability insurance tax.

EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions.

. On the 2020 edition there is no Other option please see the screenshot above. Pursuant to the Department of Tax Notice No. Big changes arrived for New Yorkers on January 1 2018 when the New York Paid Family Leave NYPFL benefit went into effect.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Taxes will not automatically be withheld from benefits but employees can request voluntary tax withholding. Paid Family Leave is an after-tax deduction.

The program provides up to 12 weeks of paid family leave benefits paid at 67 of the employees average weekly wage up to a pre-determined cap to most employees in New York. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Use Paid Family Leave.

A new Control-D report - NTAX511 Paid Family Leave has been created to provide agencies with a list of all employees with the NY Paid Family Leave deduction and the amount taken. Employers may offer employees the option of using any accrued unused paid vacation or personal. The NYPFL in box 14 is PFL tax that you paid.

The maximum employee contribution in 2018 shall be 0126 of an employees weekly wage up to the annualized New York State Average Weekly Wage. N-17-12 PDF Paid Family Leave benefits are taxable. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer.

Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. On August 25 2017 the New York State Department of Taxation and Finance DFS released highly anticipated guidance regarding taxation of PFL benefits and premium in Notice N-17-12. Paid Family Leave provides eligible employees job-protected paid time off to.

N-17-12 New York States New Paid Family Leave Program. Vacation and Personal Leave. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. Nonprofit entities that are compensating individuals for their services are required to obtain disability and paid family leave benefits coverage for all employees with the following exceptions. The maximum annual contribution is 38534.

It will be reported on employees Form W-2 beginning in tax year 2018. Bond with their child during the first 12 months after birth adoption or fostering of a child. Therefore a maximum contribution of 741 per week per employee in 2021 regardless of age gender or.

You must review and verify the rates with the agency since they can change each tax year. To set up the New York Paid Family Leave deduction as a tax code do the following. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

Fully funded by employees. Report employee contributions to state-mandated PFL on Form W-2 using Box 14 Other The State Insurance Fund reports paid family leave benefits and any federal income taxes withheld on Form 1099-G Certain Government Payments. The check box on the.

Your insurance carrier may provide options for how you will be paid for example via direct deposit debit card or paper check. What category description should I choose for this box 14 entry. 67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less.

NY Paid Family Leave Taxation Guidance Released. Contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of 7286084. Benefits paid to employees will be taxable non-wage income that must be included.

On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave. Called one of the most comprehensive paid family leave programs in the nation the law requires employers to allow employees to take paid job-protected leave to tend to a family member with a serious health condition bond with a new. New York Paid Family Leave premiums will be deducted from each employees after tax wages.

What category description should I choose for this box 14 entry. The maximum annual contribution is 42371. What Box 14 category is Nypfl.

Paid Family Leave may also be available. Reporting paid family leave taxes. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation.

NYGOVPAIDFAMILYLEAVE PAGE 1 OF 2 NEW YORK STATE PAID FAMILY LEAVE. Clergy and members of religious orders that are performing religious duties WCL 3 Group 18. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

Here are the key points. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. These steps and images are meant to give you an understanding of how to set up this tax code not to communicate the current tax rates.

Confirm the clients state is NY. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions.

State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2. The maximum contribution is 19672 per employee per year. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages.

This is 9675 more than the maximum weekly benefit for 2021. In 2021 the contribution is 0511 of an employees gross wages each pay period. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

The law allows eligible employees to take paid family leave to. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current average weekly wage of 145017.

For 2021 the contribution rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York.

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Get Ready For State Paid Family And Medical Leave In 2022 Sequoia

New York Paid Family Leave Ny Pfl The Hartford

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

Understanding Paid Leave Paid Family Leave En

How To File A Paid Family Leave Claim Using Sdi Online Youtube

Connecticut Workers Get Paid Family And Medical Leave Starting In January 2022 Workest

Paid Family Leave For Family Care Paid Family Leave

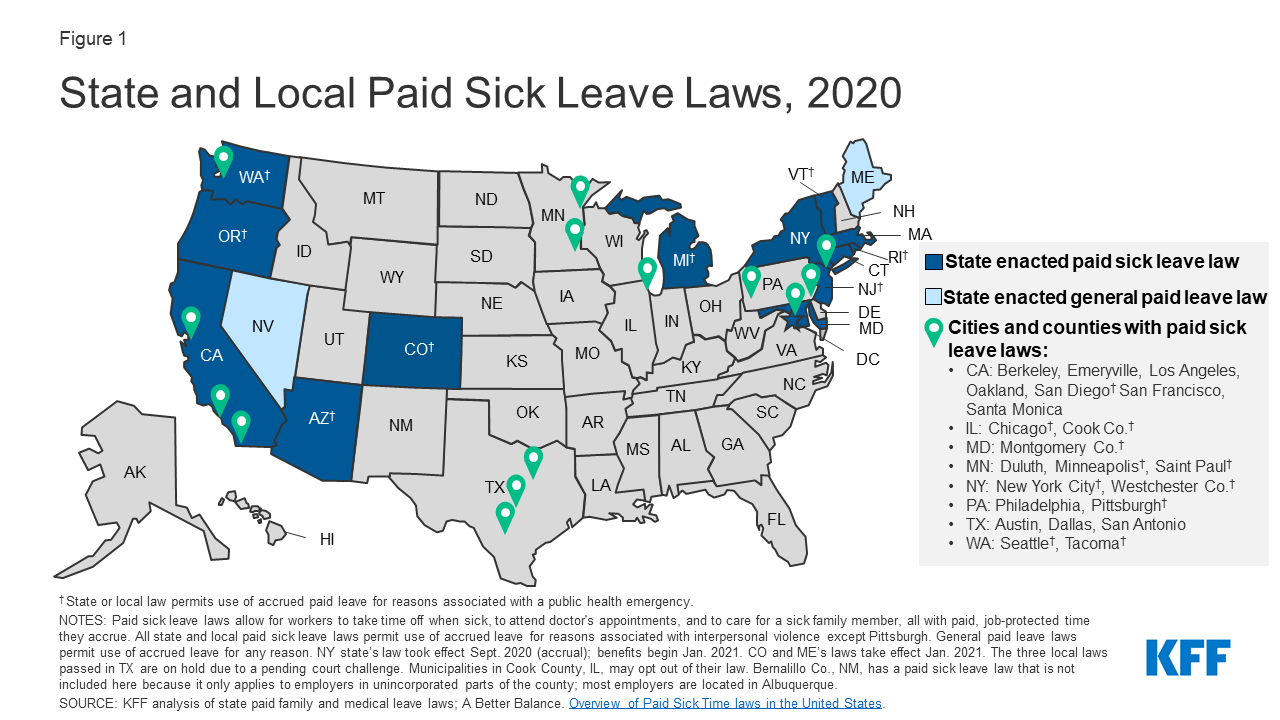

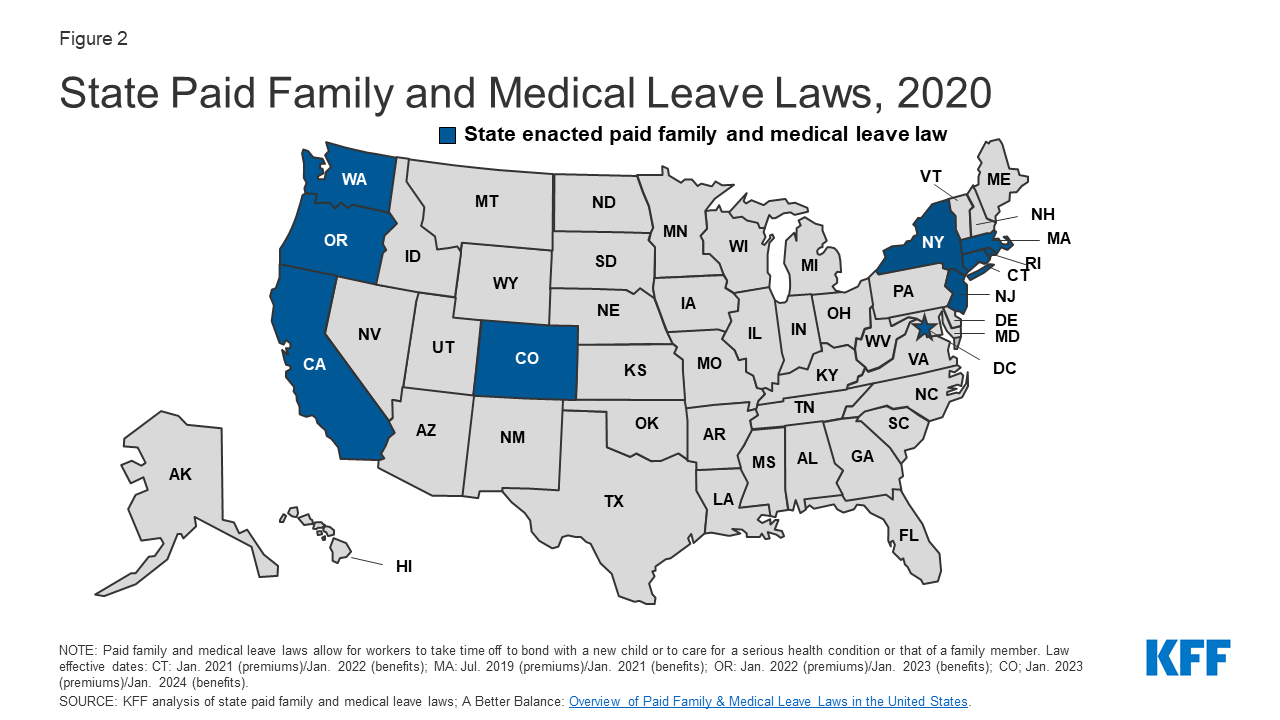

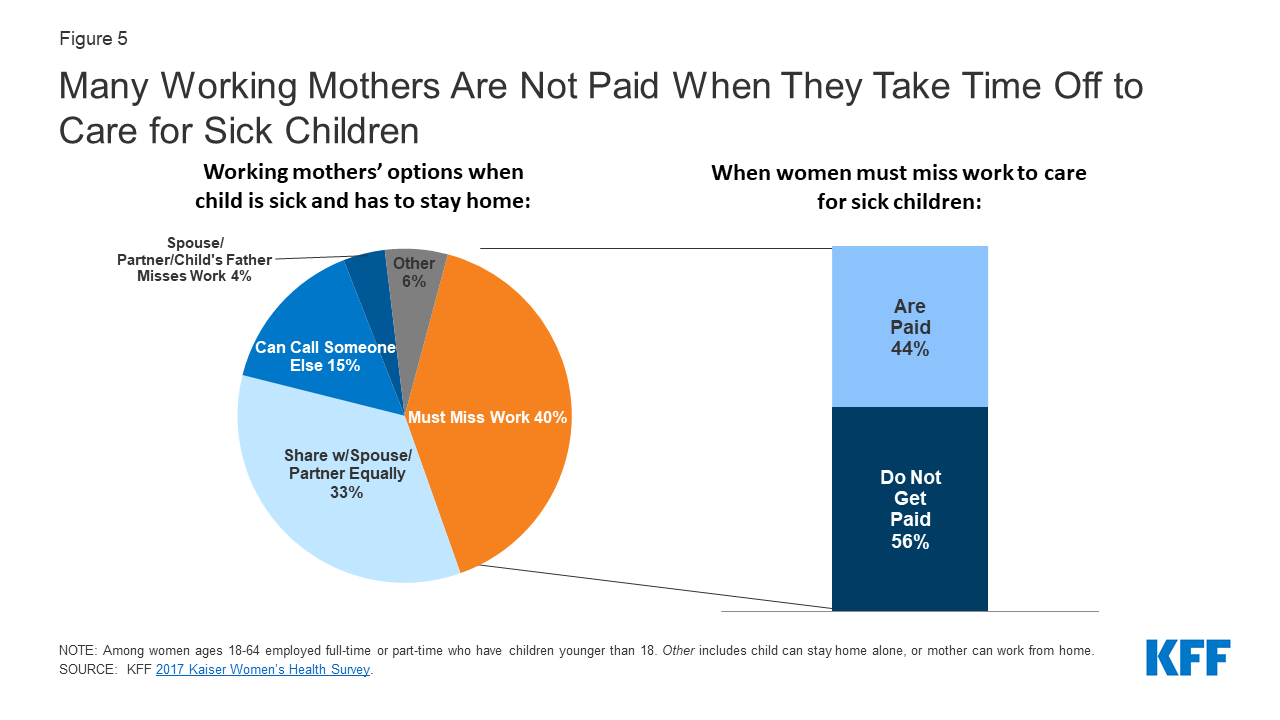

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

New York State Paid Family Leave Cornell University Division Of Human Resources

New York Paid Family Leave Updates For 2022 Paid Family Leave

New National Paid Leave Proposals Explained

Cost And Deductions Paid Family Leave

2021 State Paid Family And Medical Leave Contributions And Benefits Mercer

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Your Rights And Protections Paid Family Leave

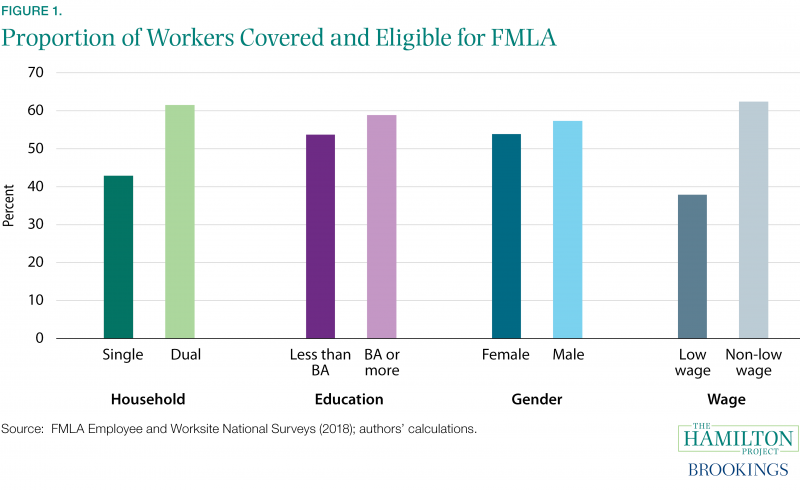

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project